IN ACCORDANCE WITH THE CARES ACT, THE CORONAVIRUS-RELATED LOAN PROVISIONS DESCRIBED BELOW EXPIRED ON SEPTEMBER 22, 2020.

Eligibility

The CARES Act requires that the participant must be affected by the coronavirus pandemic to request a coronavirus-related loan. To be eligible for a coronavirus-related loan, the participant, their spouse or dependent must have either been diagnosed with COVID-19 or the participant must have suffered adverse financial impact due to COVID-19 as a result of the participant, their spouse, or a member of the participant's household:

- being quarantined, being furloughed or laid off, or having work hours reduced due to COVID-19;

- being unable to work due to lack of childcare due to COVID-19;

- closing or reducing hours of a business that they own or operate due to COVID-19;

- having pay or self-employment income reduced due to COVID-19; or

- having a job offer rescinded or start date for a job delayed due to COVID-19.

Coronavirus-related loan provisions:

- Withdrawal up to $100,000 or 100% of your vested account balance, whichever is less (across all your retirement plans)

- Maximum amortization schedule is 5 years

- Only permitted for 180 days from the enactment of the CARES Act (3/27/2020 through 9/23/2020)

- Loan payments can be delayed (interest must still be accrued for what would be the regularly scheduled payments)

- Your Plan's loan policies are in effect regarding the number of loans permitted to a participant at a time

- For example, if your plan has a one loan limit, and you already have an outstanding loan, you will not be eligible to take another loan unless your Employer chooses to amend the limits of the plan.

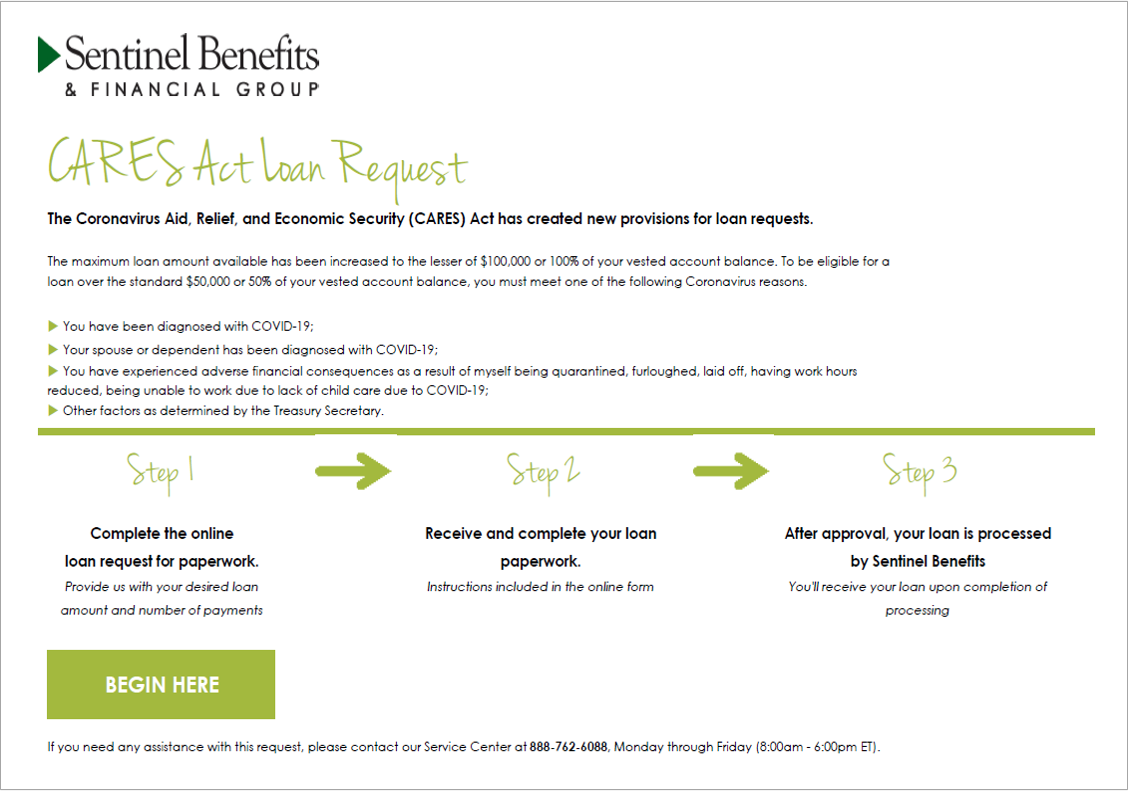

Steps for requesting your CARES Act Loan:

- Initiate request through your online account.

- Complete online web request form with desired loan details (loan amount, number of payments, etc.).

- Complete loan application (emailed to you based on your submission of Step 2).

- Plan Sponsor review and approval of loan application.

- If approved, loan application is submitted for processing.

Detailed steps for requesting:

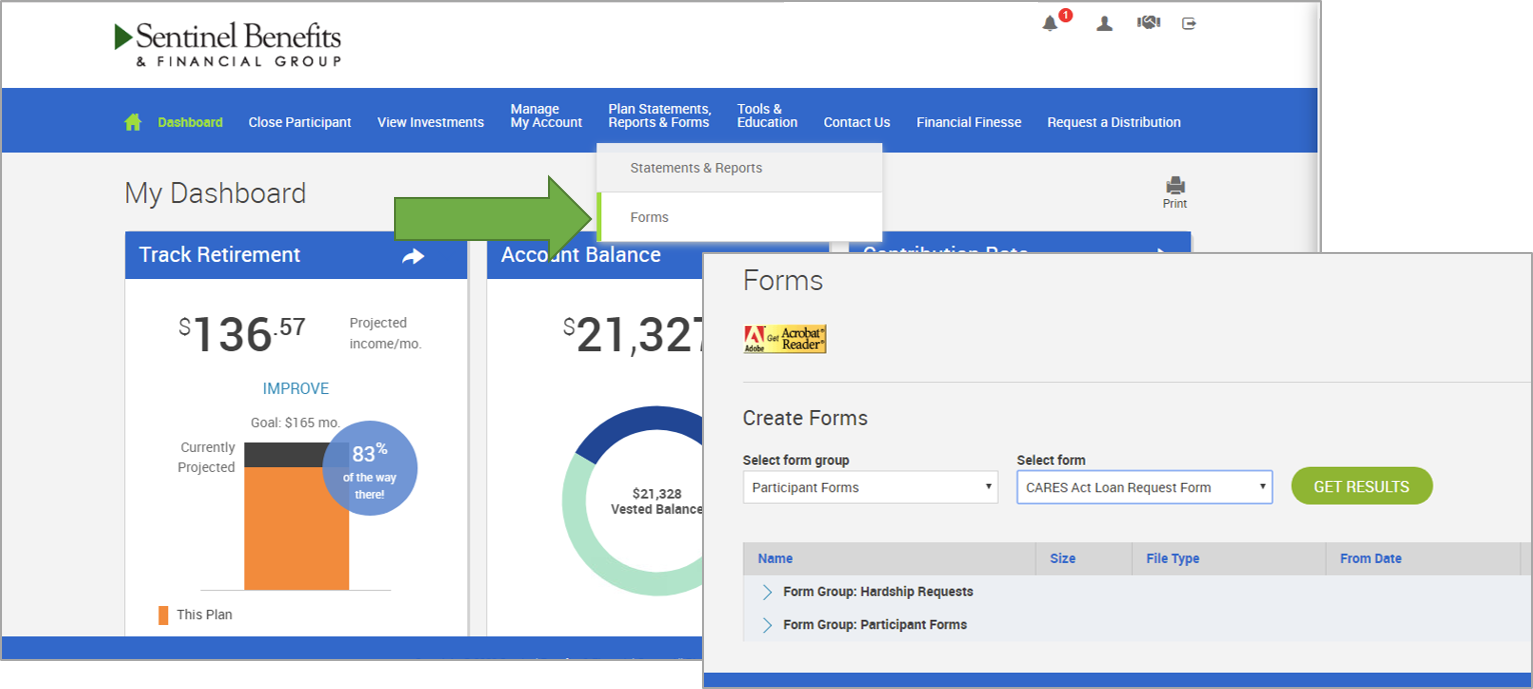

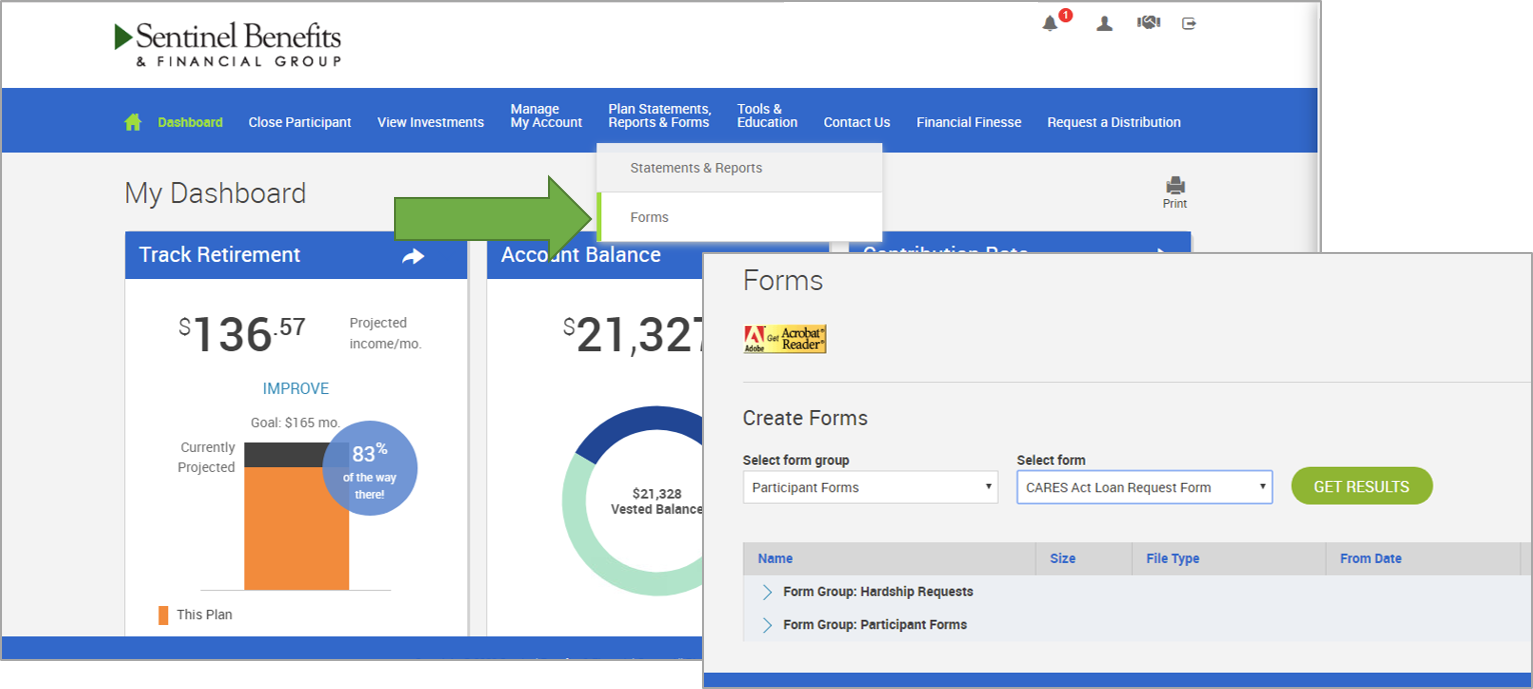

- Initiated through the Participant's online account

- Hover over Plan Statements, Reports & Forms in the navigation menu, select Forms

- Within the Select Forms menu, choose CARES Act Loan Request Form and click Get Results

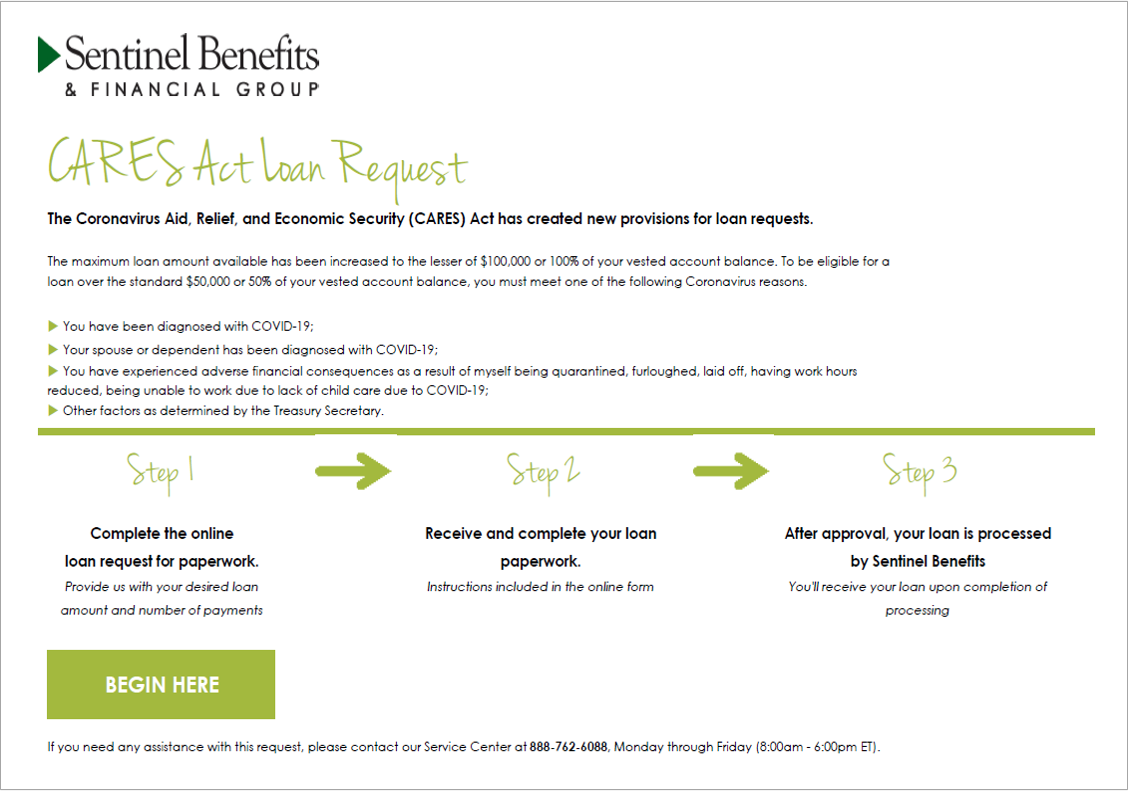

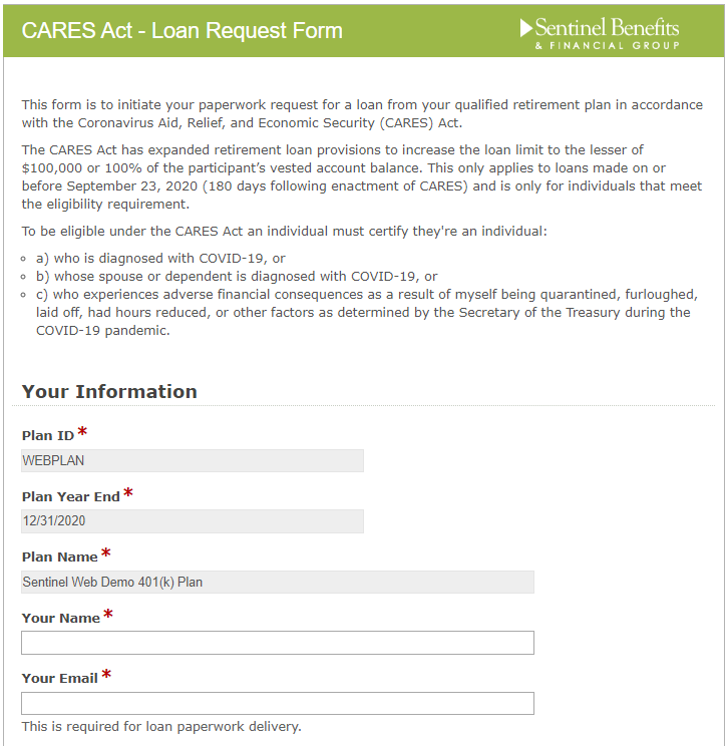

- The below page will launch to provide details about the CARES Act loans. Click Begin Here to start your loan request.

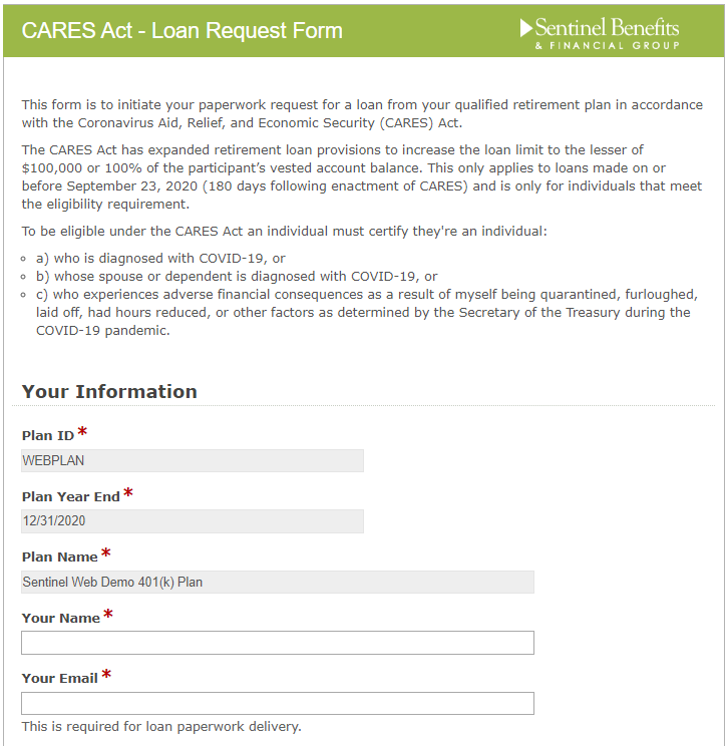

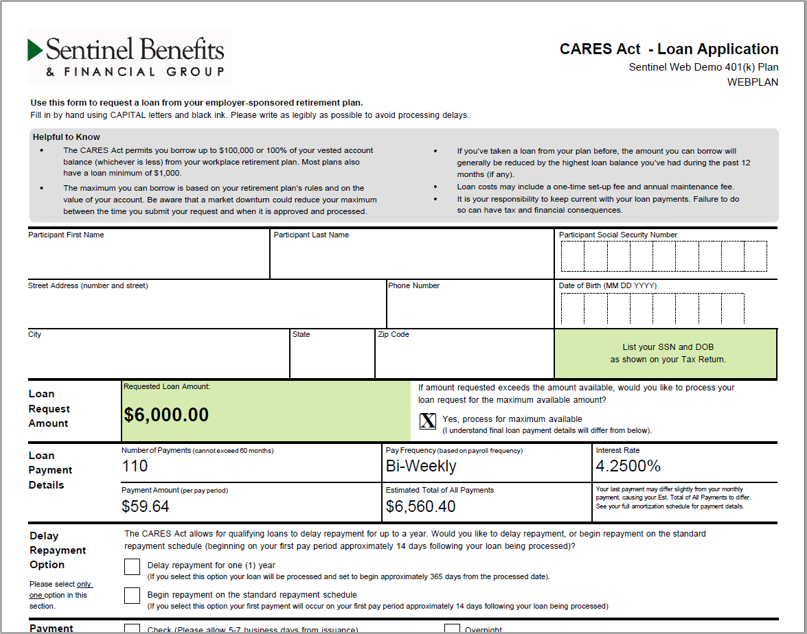

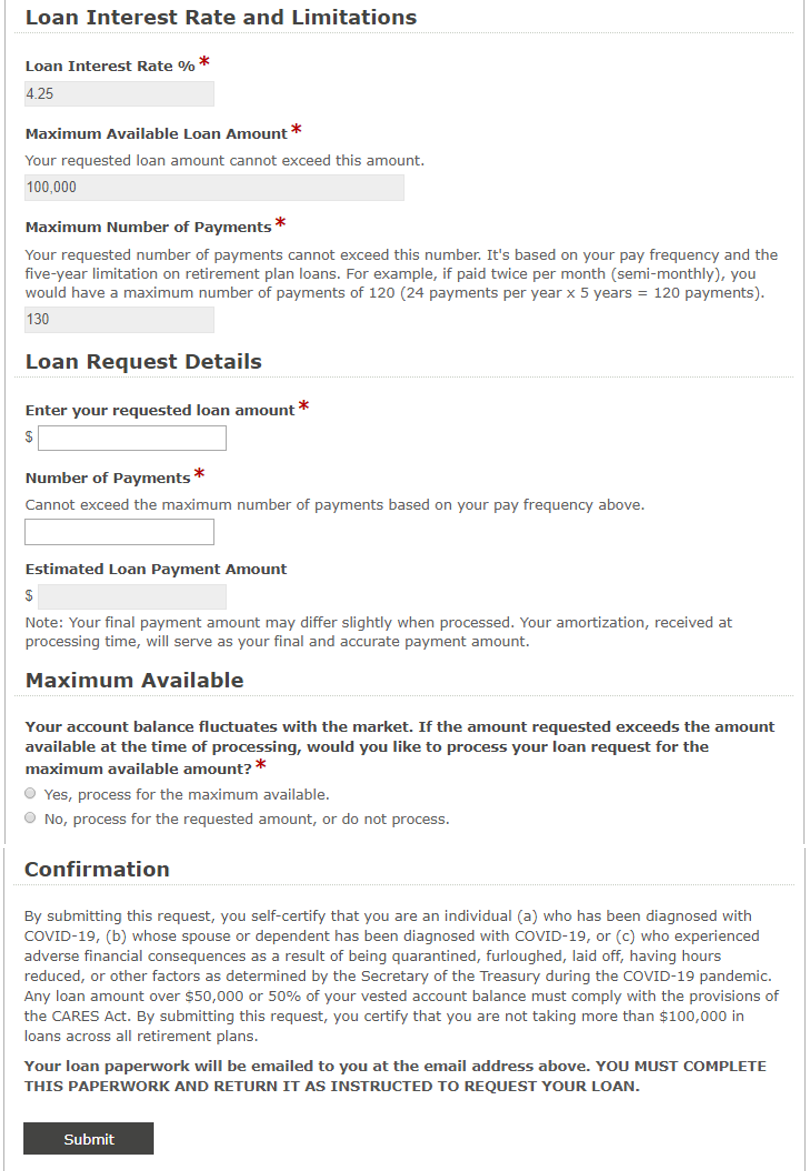

- In the Loan Request Form, enter details about your loan request, including:

- Name and email address

- Review interest rate, max loan amount*, and max number of payments

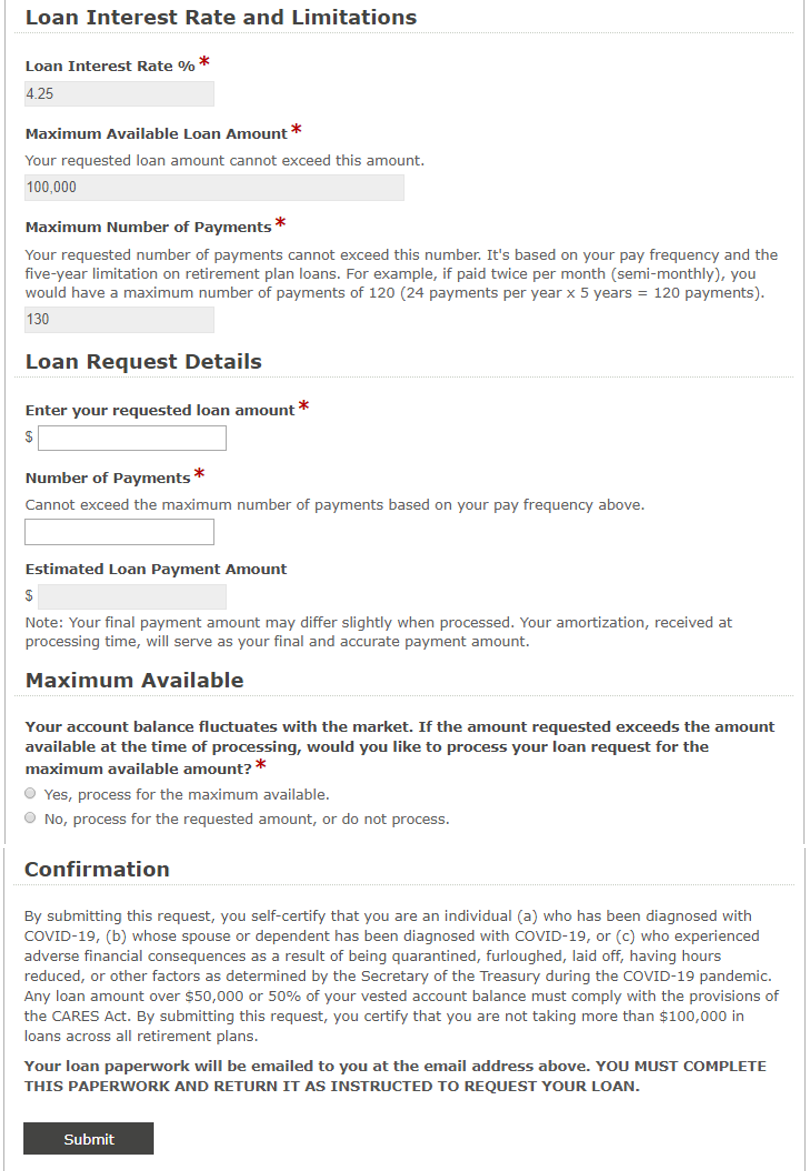

- Enter request amount

- Enter requested number of payments

- Choose maximum available options

- Review confirmation details and click Submit

- Note: Maximum loan amount is vested balance, less the 12-month high of outstanding loan balances

- After submission, you'll receive an email with your attached loan application paperwork.

- Complete this loan application, sign the document and return it using the instructions on the form for having the request approved.

- Once approved, your loan will be processed and the funds will be sent to you.

Loan Application Approval:

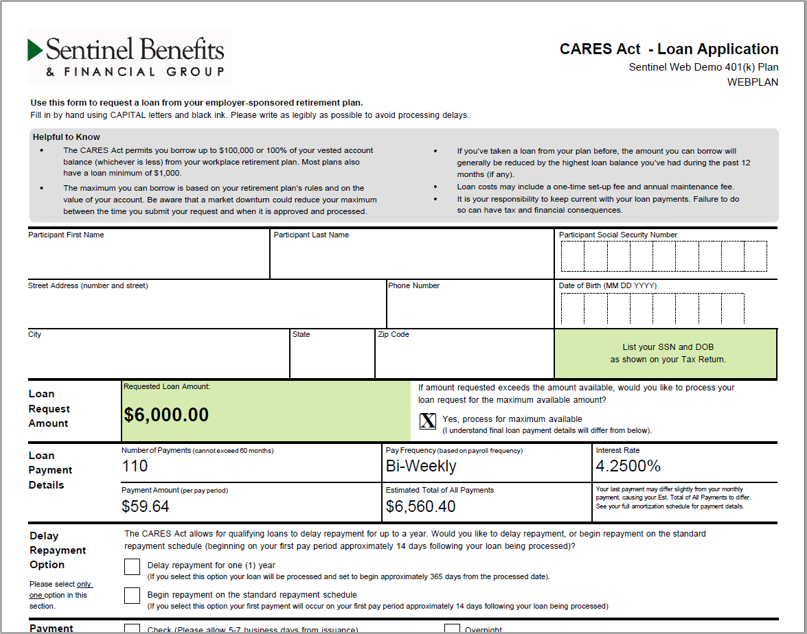

- Upon completion of the loan application, the participant should return it to the Plan's Authorized Representative for review.

- Review the request for completeness and accuracy -- employee name, DOB, ID, and address information.

- RISK CHECK: It's strongly recommended you follow a consistent and prudent process at the Plan Sponsor to verify the authenticity of this request.

- To approve, execute the document in the Trustee/Plan Sponsor Authorization section and return it to your Sentinel Benefits Plan Consultant for processing.

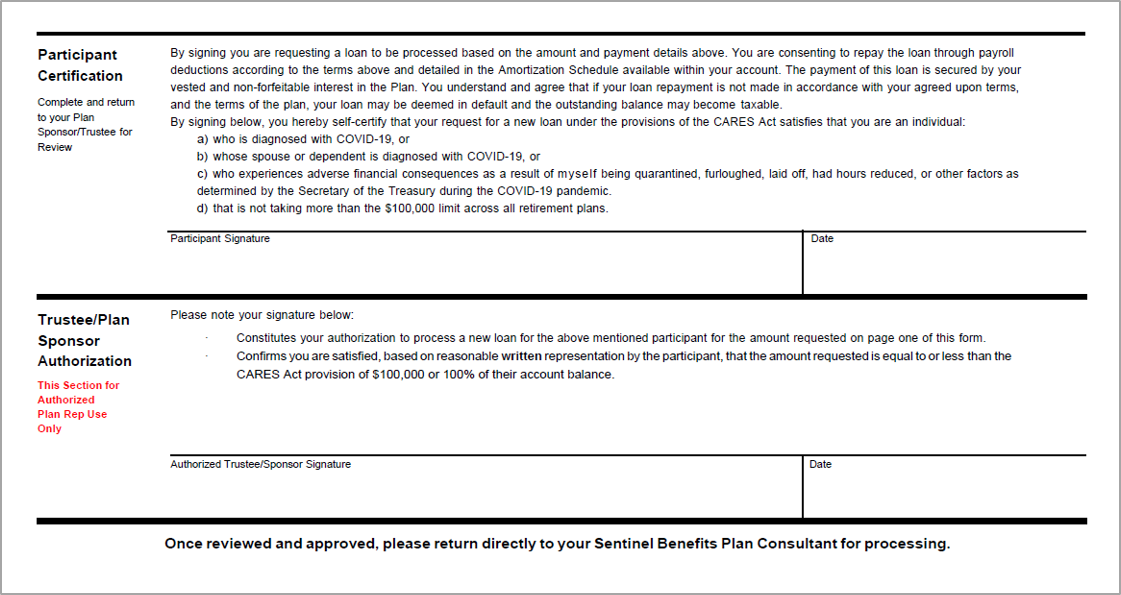

- Example approval section of the form:

- Example approval section of the form: